- Background

- Executive Summary

- Economic and Financial Context

- Artificial Intelligence in Financial Markets

- Clearing

- Corporate Bonds

- Crypto

- Fixed-Income Market Liquidity

- OTC Derivatives

- Private Asset Funds

Background

The Canadian Securities Administrators (CSA) is the umbrella organization of Canada’s provincial and territorial securities regulators. Its mission is to improve, coordinate, and harmonize regulation of the Canadian capital markets. The CSA’s key objectives are: 1) the protection of investors; 2) fair, efficient and transparent markets; and 3) the reduction of systemic risk.

In 2009, the CSA created the Systemic Risk Committee (SRC) as the principal forum for CSA staff to analyze and monitor systemic and emerging risks. It is comprised of staff from the securities regulatory authorities of Alberta (ASC), British Columbia (BCSC), Manitoba (MSC), New Brunswick (FCNB), Nova Scotia (NSSC), Ontario (OSC), Québec (AMF), and Saskatchewan (FCAA).

SRC members:

- Salma Ahmed, OSC

- Femi Alabi, OSC

- Omid Atabati, ASC

- Nouhou Ballo, AMF

- Philippe Bergevin, AMF (Co-Chair)

- John Bulmer, OSC (Co-Chair)

- Jean-Paul Calero, AMF

- Steven Clow, ASC

- Alexandre d’Aragon, AMF

- Mario Houle, AMF

- Tessa Kintoumba, AMF

- Abel Lazarus, NSSC

- Andrew Lee-Poy, OSC

- Michael Melvin, FCNB

- Jalil El Moussadek, OSC

- Paul Redman, OSC

- Eric Thong, BCSC

- Greg Toczylowski, OSC

- Sonne Udemgba, FCAA

- Patrick Weeks, MSC

- Steven Weimer, ASC

This annual report provides an analysis of recent financial market trends and vulnerabilities in Canadian capital markets. The report also outlines the CSA’s efforts to mitigate those vulnerabilities and associated risks. The opinions in this report are those of SRC members. They do not necessarily reflect the official views of CSA members.

Executive Summary

The Canadian financial system remained resilient in 2025 despite heightened economic and financial uncertainty. The trade conflict slowed the economy, especially the manufacturing sector, but growth was stronger than initially expected. The S&P/TSX was among the world’s top performing indices after a brief spike in volatility in April. Liquidity in government and corporate bond markets remained steady, and investment fund net flows were positive. Clearing agencies handled periods of volatility well and adapted to major industry changes without disruption. Canada’s OTC derivatives market continued to grow, mainly due to risk management activity.

Our 2025 annual report highlights trends and risks that need ongoing attention. The rise of artificial intelligence (AI) is a major development that could reshape economies and financial systems, but it also brings new risks. Canadian non-financial corporations remained broadly resilient in 2025, but higher refinancing needs in 2026 could raise the likelihood of financial stress for firms impacted by trade tensions, especially if trade tensions and the economic environment worsen. Stablecoins, crypto assets tied to a reference value, are growing quickly. Their role in money markets and high market concentration among a few issuers call for greater oversight. Canada and other countries are establishing stablecoin regulatory frameworks. Market conditions in 2025 also put private asset funds under liquidity pressure. The CSA is working on proposals to strengthen the liquidity risk management of investment funds, including improving the alignment of funds’ redemption terms with the liquidity of their underlying assets. These changes would apply to all investment funds, including private asset funds, but not private asset fund-like entities with similar redemption features.

Economic and Financial Context

In 2025, the global economy proved more resilient than expected despite U.S. trade policy. Broader trade conflict was avoided through bilateral deals, and the inflationary impact of tariffs in the U.S. was slow to appear. The U.S. economy grew solidly, though unemployment edged higher. About 85% of Canadian exports to the U.S. are CUSMA[1]-compliant and exempt from tariffs, but sector-specific tariffs on steel, aluminum, vehicles and lumber hurt Canada’s economy.[2] GDP growth was limited to an estimated 1.3% in 2025 as exports fell and investment stalled. Canada has yet to reach a trade deal with the U.S., and the CUSMA review is expected in July 2026.

After the April stock market correction following “Liberation Day,”[3] markets trended upward, driven by the artificial intelligence boom. In the U.S., the S&P 500 returned 16% in 2025. Tech stocks surged on AI enthusiasm, but valuations are now at historically high levels, raising concerns about a correction. The AI-linked “Magnificent Seven”[4] now make up about 34% of the S&P 500’s market capitalization, reducing the index’s diversification and increasing vulnerability. Canadian markets were among the world’s best performers, with the S&P/TSX Composite up about 28%. Canadian materials stocks nearly doubled in value in 2025, boosted by gold prices amid trade tensions and geopolitical risks.

In fixed-income markets, bond yields fell as trade tensions and inflation were lower than expected after “Liberation Day.” The yield on 10-year U.S. government bonds dropped from 4.60% in May to about 4.15% by year-end. Canadian yields remain below U.S. levels, reflecting Canada’s weaker economy. Despite falling yields, yield curves steepened as long-term rates held firm while short-term rates shifted lower. High deficits and rising public debt in many countries are supporting long-term yields. Corporate bond spreads narrowed and are near historic lows despite economic uncertainty.

Artificial Intelligence in Financial Markets

AI could reshape economies and financial systems. In financial markets, major institutions, asset managers and market infrastructures are gradually adopting AI.[5] They use it for asset allocation, fraud detection, and algorithmic trading, among other tasks. AI is a powerful productivity tool that can process massive data in real time and automate complex functions. At the macro level, it can boost growth and competitiveness.

But this shift could ultimately have implications for financial stability. The sector is dominated by the “Magnificent Seven” along with private players such as OpenAI. These firms control cloud infrastructures, GPU computing, and core AI models. This concentration creates third-party dependencies across the financial system. A technical disruption or cyberattack affecting one of these providers could spread quickly across markets.

Heavy reliance on a few AI models may lead to stronger market correlations and hidden linkages. If many participants use AI for trading or pricing for instance, similar decisions could amplify stress and trigger synchronized selloffs, thereby worsening liquidity conditions and volatility.[6]

Cyber risks are growing as financial institutions and market participants expand their use of AI. More data flows and new interaction channels increase exposure. Malicious actors are also using AI to automate and scale attacks. In our 2025 Systemic Risk Survey, respondents said AI adds to concerns about cybersecurity, including social engineering and deepfakes.[7]

AI has the potential to become a key driver of productivity and competitiveness, but it also can create new risks. Policymakers face the challenge of supporting AI growth while ensuring it does not become a source of global financial instability.

Clearing

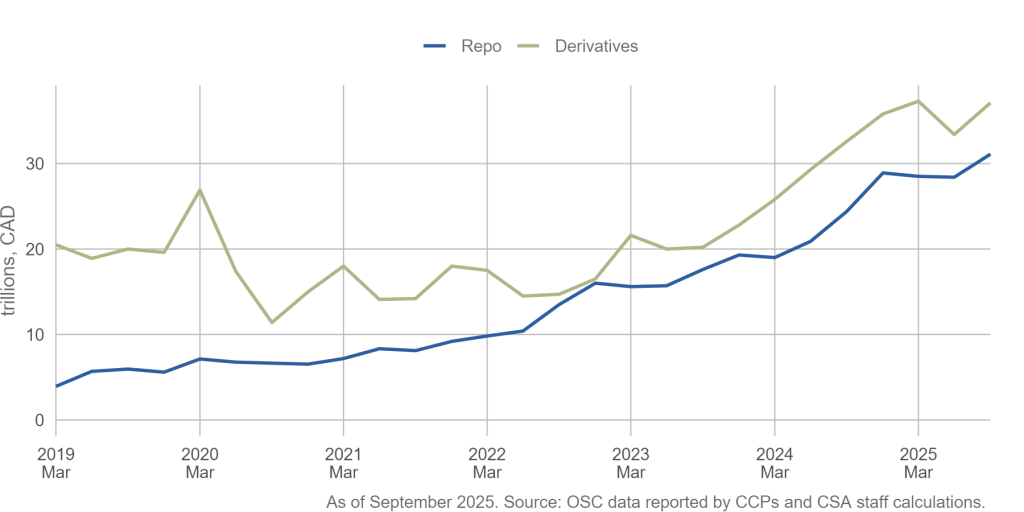

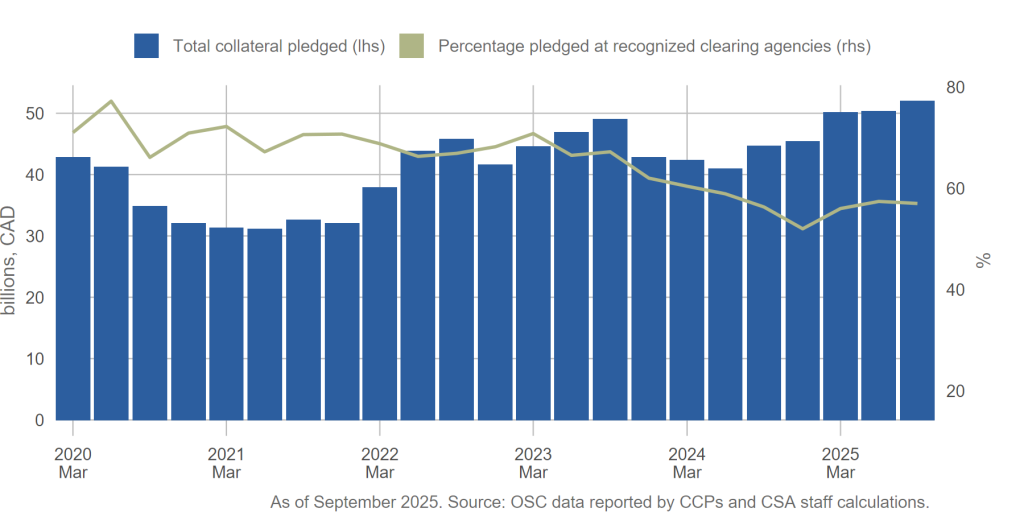

Clearing activity in Canada continues to rise compared with previous years.[8] In the third quarter of 2025, the notional value of cleared derivatives reached about $37 trillion, 14% higher than in the same quarter of 2024. Fixed-income repo clearing rose 27% over the same period (Figure 1). Total collateral requirement, which better reflects participants’ risk exposure to central counterparties, reached about $52 billion at the end of Q3 2025, a 16% increase from Q3 2024, driven by higher volatility and increased clearing activity (Figure 2).

Figure 1 – Notional value of repo and derivatives cleared by Ontario Participants at CCPs recognized or exempt in Ontario

Figure 2 – Collateral pledged by Ontario Participants to CCPs recognized or exempt in Ontario

Systemically important recognized clearing agencies[9] are highly interconnected and could harm financial stability if their services are disrupted. As of the third quarter of 2025, collateral posted at these recognized clearing agencies (i.e., CDS, CDCC and LCH Limited) made up about 57% of the total collateral posted by Ontario participants across all clearing agencies (Figure 2).

The set of recognized systemically important CCPs has been stable over the past decade, but some exempt CCPs have grown in importance in Canada in recent years. Provincial securities regulators closely monitor these firms for risks to Canada’s capital markets. Exempt clearing agencies in Canada are usually designated as systemically important financial market infrastructures in other major jurisdictions, such as the U.S. and the U.K., and are subject to strict prudential and supervisory rules by their home regulators.[10]

Monitoring operational developments at systemically important CCPs is critical. CDS successfully implemented its Post-Trade Modernization (PTM) project launched on April 28, 2025, upgrading its technology and reporting systems. Several CCPs also plan to outsource more functions and move to cloud services, concentrating risk among a few third-party providers. Internationally, CPMI-IOSCO is working on two initiatives to address concerns about cybersecurity and third-party outsourcing.

Overall, vulnerabilities linked to central clearing remain low, with no major weaknesses identified. CCPs have shown resilience during recent market stress, including after “Liberation Day,” and managed industry changes, such as the PTM launch, without disruption.

Corporate Bonds

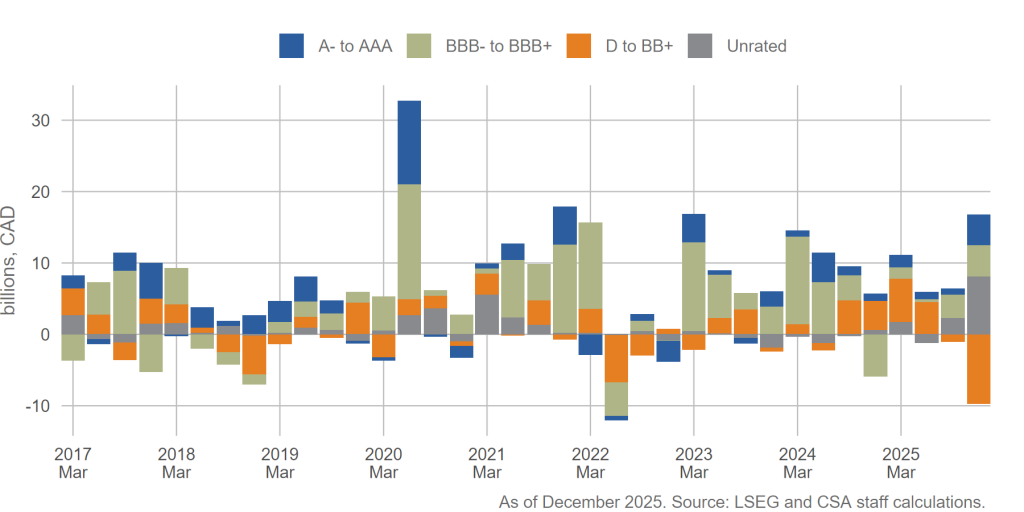

In 2025, Canadian non-financial corporate bonds showed resilience in sectors affected by tradepolicy despite pressure from U.S. tariffs and refinancing challenges. The uncertainty created by tariffs quickly ended the wave of credit upgrades seen in the first quarter. By the second and third quarters, downgrades slightly outpaced upgrades. The sectors most exposed, industrials, energy, materials and consumer cyclicals,[11] have remained stable in terms of insolvency rates, supported by the Bank of Canada rate cuts and fiscal measures in energy and materials. Still, uncertainty clouds their outlook.

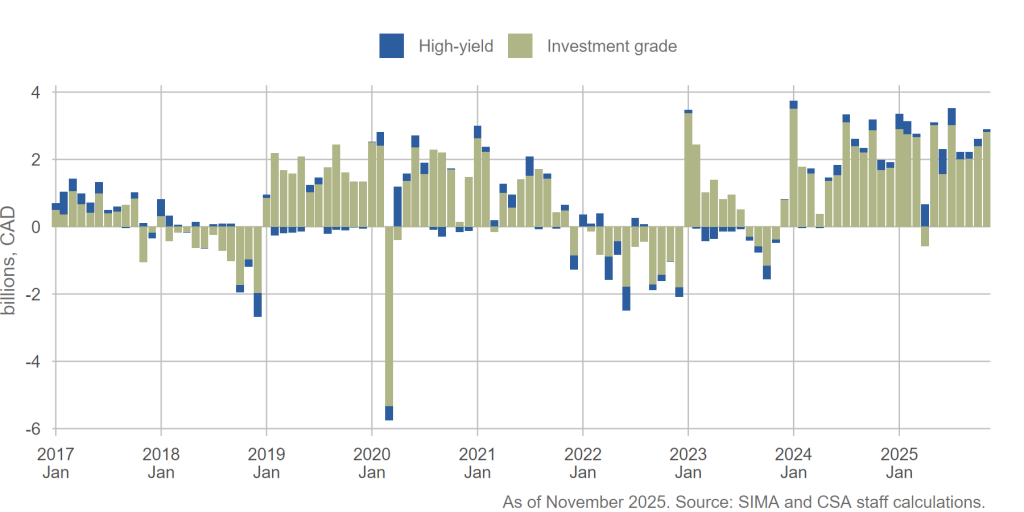

Net issuance fell sharply in Q3—especially in tariff‑exposed sectors—but rebounded in Q4 on record industrial‑sector issuance (Figure 3). Issuers in the materials sector accelerated bond issuance in Q1 2025, likely anticipating U.S. tariffs with net issuance exceeding 4x the quarterly levels posted since mid-2020.[12] Meanwhile, issuance in the energy sector has been rising supported by higher expected energy usage for AI.[13] In Q4, record issuance from industrial issuers potentially reflected heightened financing needs for trade-related adjustments including supply-chain diversification.[14]

Figure 3 – Non-financial corporate bonds, net issuance

Significant credit upgrades occurred across non-financial sectors in early 2025, but downgrades outpaced upgrades after U.S. tariffs took effect—though only temporarily. So far, downgrades have been concentrated in the materials and technology sectors, both showing mixed performance. In the materials sector, critical minerals, gold, and potash performed strongly, while steel and aluminum were hurt by U.S. tariffs. In technology, AI firms grew robustly, while telecom firms faced operational risks and intense competition.

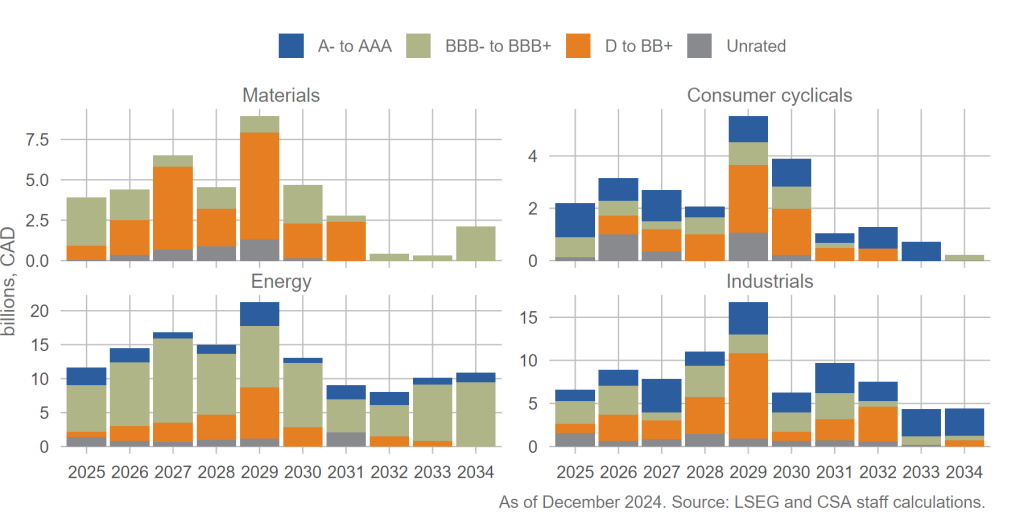

Refinancing pressure was high for industrials—especially for manufacturing—and consumer cyclicals sectors in the second quarter of 2025. These sectors issued large amounts of debt to roll over maturing obligations. This pressure is expected to grow in 2026, as more firms with high-yield debt face refinancing deadlines (Figure 4). The materials and energy sectors face similar challenges but are performing better thanks to strong global demand. In addition, new government support was announced in the 2025 federal budget.[15] Nevertheless, the need to refinance or restructure debt amid uncertainty could make it harder for firms to meet their obligations if trade policy changes or market sentiment pushes borrowing costs higher.

Figure 4 – Non-financial corporate bonds, maturity by year

Weaknesses in sectors affected by trade tensions could have wider effects on the Canadian economy. These sectors account for about 27% of GDP, so stress could lead to lower business investment, job losses, and reduced consumer spending, which in turn could hurt households’ and businesses’ ability to pay their debts.[16] While technology is not directly affected by trade tensions, telecom firms face operational risks and intense competition, contributing to recent credit downgrades.

Credit rating downgrades in industrials, materials, and technology—especially among manufacturers, steel and aluminum producers, and telecom firms—could spread to other firms in those sectors. This may limit access to capital and trigger defaults in key sub-sectors. With refinancing activity expected to remain high in industrials and consumer cyclicals, many firms could struggle to meet debt obligations if market conditions persist or worsen.[17]

Crypto

The crypto asset sector in 2025 was shaped by new regulatory frameworks, growing institutional participation and continued financial innovation. Global market capitalization reached a record of about US$4.4 trillion in October, driven mainly by Bitcoin and stablecoins, before declining more recently.

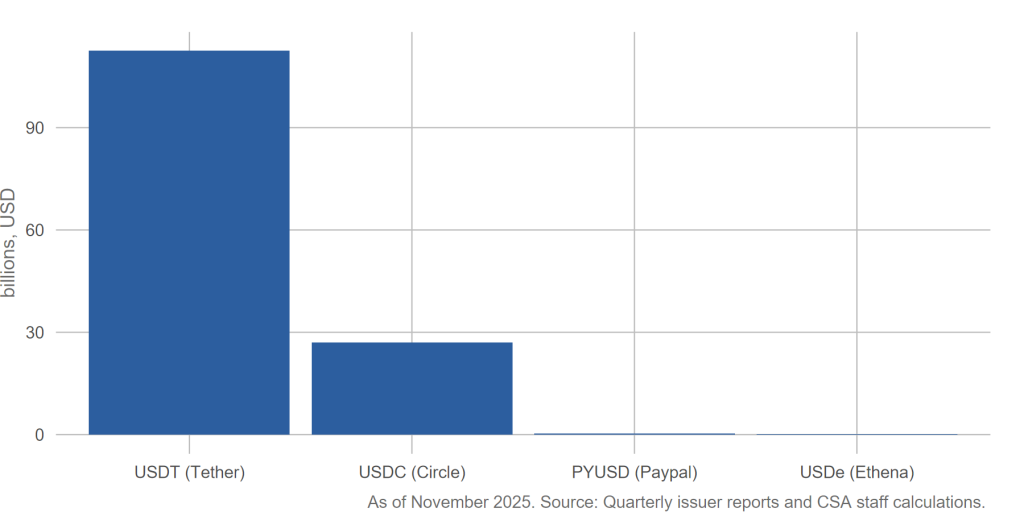

Stablecoins now play a critical role in the crypto ecosystem. Their combined global market capitalization exceeds US$300 billion, or roughly 10% of the total crypto market. Two issuers, USDT (Tether) and USDC (Circle), control almost 90% of the stablecoin market. Initially designed to provide liquidity on crypto platforms, stablecoins now support decentralized finance (DeFi), collateralize derivatives, settle international payments, and enable retail transactions.

The U.S. GENIUS Act, adopted in 2025, reinforces the growing role of stablecoins. That act will require stablecoins used for payment to be fully backed by highly liquid assets like U.S. Treasury bills (T-bills). Tether and Circle together hold about US$140 billion in T-bills, comparable to large insurers and some foreign governments (Figure 5). This reliance on T-bills raises the risk of contagion from stablecoin markets to traditional financial markets in the event that stablecoin redemptions surge. The contagion risk is currently low as the market for T-bills is much larger than the market for stablecoins.

Figure 5 – Size of stablecoin reserves of U.S. Treasury bills

Other jurisdictions are also introducing stablecoin frameworks. While the U.S. moved ahead with the GENIUS Act, the European Union rolled out MiCA and the ESMA-EBA oversight framework. In Canada, in the context of the 2025 federal budget, the government has introduced legislation to regulate the issuance of fiat-backed stablecoins. Details will come in future regulations, but the proposed Stablecoin Act would govern issuers other than financial institutions and set rules for reserve assets and disclosures.

In November 2025, the OSC approved the final prospectus of QCAD Digital Trust to distribute a fiat-backed stablecoin pegged to the Canadian dollar on a 1:1 basis. The issuer also received exemptive relief from some prospectus and reporting requirements to create a tailored framework for stablecoins. CSA staff are of the view that fiat-backed crypto assets are generally securities and/or derivatives.

High market concentration among a few stablecoin issuers could pose financial stability risks as the sector grows. If growth continues, a sudden loss of confidence in major stablecoins could lead to large sales of government securities, disrupting money market liquidity. Stablecoins also present cyber and operational risks.[18]

Despite rapid growth, stablecoins do not yet pose a systemic risk given the size of global financial markets. However, their integration into money markets through T-bill holdings and concentration among a few lightly regulated issuers justify increased vigilance. Global regulatory coordination is essential to manage these risks and prevent regulatory arbitrage.

Fixed-Income Market Liquidity

Trade-related uncertainty had little impact on fixed-income liquidity. In the past, economic uncertainty and market volatility have sometimes caused liquidity problems when selling pressures rose and dealers hit their limits or pulled back from trading.

We saw some selling pressures in early April 2025 in some markets, but it was short-lived. Investors moved to increase cash holdings, and some leveraged positions were unwound, but markets recovered quickly. U.S. government bond yields rose sharply during this period as investors assessed the impact of U.S. trade policy changes. Normally, U.S. bond yields fall during financial stress because demand for safe assets pushes prices up.[19]

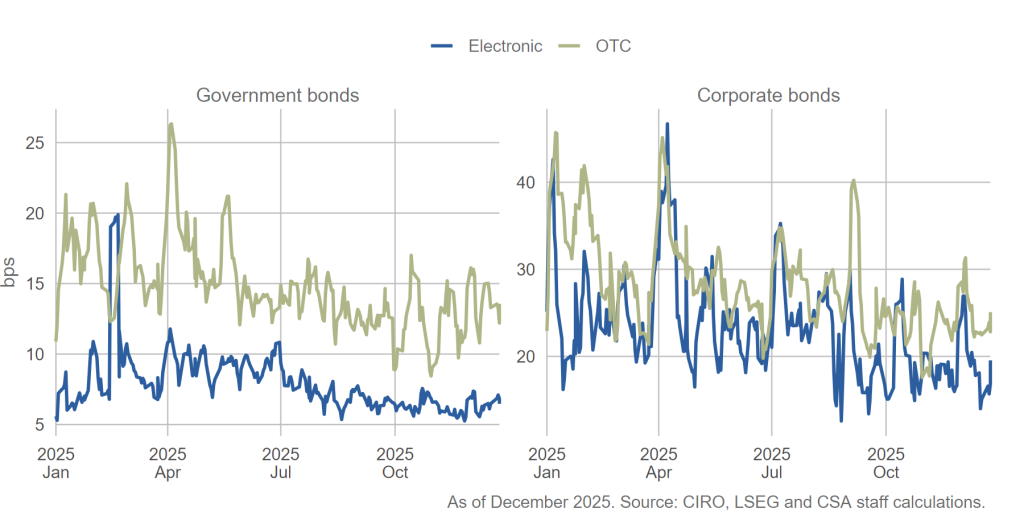

In Canada, liquidity stayed stable throughout April in both government and corporate bond markets. Bid-ask spreads for Canadian government bonds widened briefly after “Liberation Day,” when volatility spiked, but returned to normal quickly (Figure 6). Overall, corporate bond trading volumes remained within normal ranges.

Figure 6 – Estimated bid-ask spreads for round-lot trades ($1-5m)

Fixed-Income Mutual Funds

Fixed-income mutual funds saw steady and positive net flows in 2025. During times of economic uncertainty, these funds can face net outflows as investors seek cash. Large outflows can create challenges, especially when underlying markets, such as corporate bond markets, are less liquid. Asset sales by investment fund managers to meet redemptions can worsen liquidity problems in those markets.

In 2025, credit quality for fixed-income mutual funds slipped slightly but remains strong and healthier than after the COVID-19 shock. In 2020, credit quality fell as funds increased exposure to corporate bonds, but that trend reversed in recent years.

Figure 7 – Fixed-income mutual funds net flows

Money market funds (MMFs) saw net inflows in 2025 despite falling interest rates. In 2024, MMFs adapted to the end of the Bankers’ Acceptance (BA) market. Recent Bank of Canada analysis found that MMFs responded by increasing their exposure to commercial paper.[20] Preliminary SRC estimates show asset-backed commercial paper accounts for a large share of this increase and now makes up about a quarter of MMFs total net assets.

Fixed-Income Exchange-Traded Funds (ETFs)

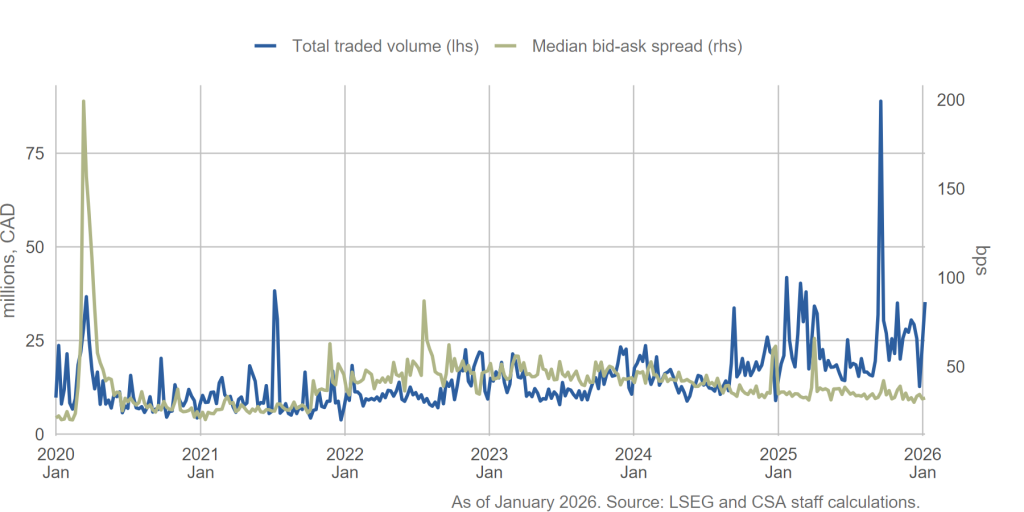

Fixed-income ETFs stayed liquid in 2025 despite economic uncertainty and market volatility. In theory, a major financial shock could hurt liquidity in primary and secondary ETF markets, leading to wider bid-ask spreads, lower trading activity and prices that diverge from underlying values. In practice, ETFs have proven resilient to shocks, including COVID-19 and the announcement of U.S. tariffs. In 2025, traded volumes increased and bid-ask spreads remained stable for fixed-income ETFs (Figure 8).

Figure 8 – Canadian bond ETF Liquidity

Recent SRC analysis of large fixed-income and equity ETFs confirms their resilience. Bid-ask spreads typically widen during stress but tighten quickly afterward. Spreads on fixed-income ETFs are usually higher and more sensitive to volatility and funding conditions than those on equity ETFs. However, fixed-income ETFs reacted more moderately than equity ETFs to the “Liberation Day” U.S. tariff announcements in terms of price volatility and spreads. Overall, these findings align with recent evidence from the OSC ETF study.[21] We continue to monitor market-quality indicators using CSA’s Market Analysis Platform (MAP) data to track how markets respond to new developments.

OTC Derivatives

Canada’s OTC derivatives market grew steadily in 2025. Interest rate derivatives drove most of the increase, mainly because of risk management activity and the completion of the CDOR-to-CORRA benchmark transition in 2024.

Regulatory changes included a rewrite of trade reporting rules effective in July 2025. The update introduced global identifiers and expanded data standards. Regulators also finalized changes to mandatory clearing rules in September 2025 to reflect the shift to risk-free benchmarks and add other liquid products. These measures, effective in March 2026, aim to improve transparency, reduce counterparty risk, and support systemic risk monitoring while aligning with international standards.

Private Asset Funds

Private asset funds—sold without a prospectus and investing in private equity, private debt, or real estate—have grown sharply over the past 15 years.[22] OSC Investment Fund Survey data shows the number of fund managers offering these products in Canada has risen 40% since 2020.[23] Total net assets in private asset funds have doubled since 2020, reaching $152 billion by the end of 2024. By comparison, hedge funds held $97 billion in net assets. These figures do not include private asset fund-like entities[24] for which structured financial data is unavailable.

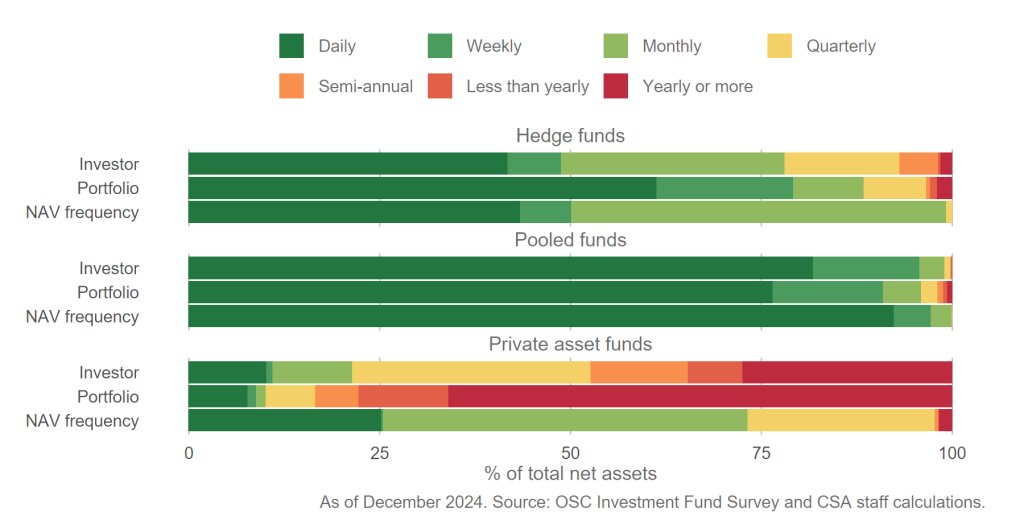

In 2025, some private asset funds faced significant liquidity pressure. Higher uncertainty may have contributed to increased redemption requests. Several funds and fund-like entities—predominately focused on real estate—suspended or restricted redemptions to ensure investors are repaid in a fair and orderly way. Many of these funds report liquidity mismatches, meaning investors can redeem units faster than the underlying assets can be sold (Figure 9). These mismatches likely contributed to the decision to suspend or restrict redemptions. In contrast, other exempt funds—such as pooled funds and hedge funds—do not report similar mismatches because they hold more liquid portfolios and have redemption notice periods aligned with their portfolio liquidity.

Figure 9 – Exempt fund investor liquidity, portfolio liquidity, and NAV calculation frequency, 2024

The continued growth of private asset funds could offer benefits for investors and companies. The OSC’s Long-Term Asset Fund Project is exploring ways to support new and innovative investment fund products that would allow retail investors to invest in private assets, which are normally only available to institutional and high net worth investors.

Aligning redemption terms with portfolio liquidity would help reduce liquidity mismatches. The CSA has proposed rule changes to strengthen the liquidity risk management of investment funds, including the alignment of investor redemption timelines with portfolio liquidity.[25] These proposed changes would apply to all investment funds, including private asset funds, but not to similar fund-like entities that are not considered “investment funds” under Canadian securities law.

Closing data gaps is critical to financial stability. More information on private asset fund-like entities would give regulators a clearer view of their size, exposures, leverage and liquidity. While reducing regulatory burden is important, it should be balanced against a growing blind spot and the cost savings associated with AI-assisted data reporting.

[1] Canada-United States-Mexico Agreement on free trade in North America.

[2] Government of Canada, Budget 2025, https://budget.canada.ca/2025/report-rapport/overview-apercu-en.html.

[3] The term “Liberation Day” refers to the announcement on April 2, 2025, by Donald Trump regarding the imposition of a broad package of import duties, invoking the International Emergency Economic Powers Act.

[4] Microsoft, Apple, Alphabet, Amazon, Meta, Nvidia, and Tesla.

[5] Gartner, Gartner Survey Shows Finance AI Adoption Remains Steady in 2025, November 2025, https://www.gartner.com/en/newsroom/press-releases/2025-11-18-gartner-survey-shows-finance-ai-adoption-remains-steady-in-2025.

[6] Financial Stability Board, The Financial Stability Implications of Artificial Intelligence, November 2024, https://www.fsb.org/2024/11/the-financial-stability-implications-of-artificial-intelligence/.

[7] CSA Systemic Risk Committee, Systemic Risk Survey 2025, December 2025, https://www.securities-administrators.ca/csa-activities/csa-systemic-risk-committee/2025-csa-systemic-risk-survey/.

[8] The Canadian clearing sector consists of derivatives, repos and cash securities cleared by Canadian participants through domestic and foreign central counterparties (CCPs). This report section focuses on activity and collateral posted by Ontario-based participants through the 12 CCPs recognized or exempt from recognition as clearing agencies in Ontario, providing a reliable and representative view of overall Canadian clearing activity.

[9] Refer to National Instrument 24-102 Clearing Agency Requirements, Part 2, Section 2.2 for the CSA’s guiding factors in determining whether a clearing agency is systemically important to a jurisdiction’s capital markets.

[10] The OSC currently exempts a number of CCPs from recognition by order with terms and conditions and has a memorandum of understanding with each of the home regulators that facilitates information sharing. The OSC meets with the home regulators on a regular or as-needed basis.

[11] The industrials sector includes manufacturing, transportation, construction, and supporting activities not related to retail and automotive. Materials include the extraction and processing of raw minerals, metals, and materials not related to energy. Consumer cyclicals refer to retail goods and services, including automotive.

[12] Canadian measurements sourced from LSEG and OSC staff calculations.

[13] RBC, Power Struggle: How AI is challenging Canada’s electricity grid, December 2024, https://www.rbc.com/en/thought-leadership/climate-action-institute/power-struggle-how-ai-is-challenging-canadas-electricity-grid/.

[14] James Berkow, Canadian corporate debt binge unfolding as businesses seek to retool in face of trade war, The Globe and Mail, November 2025, https://www.theglobeandmail.com/business/article-canada-corporate-debt-binge-businesses-seek-retool-trade-war/.

[15] The Government of Canada’s Budget 2025 focusses on supporting national projects to fortify the oil and gas supply chains and investments to develop critical minerals.

[16] Industrials contribute around 8-10%, energy 10%, materials 4%, and consumer cyclicals 5% of GDP. Natural Resources Canada, Energy Fact Book 2024-2025, 2024, https://energy-information.canada.ca/sites/default/files/2024-10/energy-factbook-2024-2025.pdf; Statistics Canada, Gross domestic product by industry, December 2024, https://www150.statcan.gc.ca/n1/daily-quotidien/250228/dq250228b-eng.htm.

[17] Moody’s, US firms’ default risk hits 9.2%, a post-financial crisis high, March 2025, https://www.moodys.com/web/en/us/insights/data-stories/us-corporate-default-risk-in-2025.html.

[18] European Systemic Risk Board, Crypto-assets and decentralised finance: Report on stablecoins, crypto-investment products and multifunction groups, October 2025, https://www.esrb.europa.eu/pub/pdf/reports/esrb.report202510_cryptoassets.en.pdf?347510c016928b8c2f74825965cd20a9.

[19] Bond prices are inversely correlated with yields. For example, when bond prices go up, bond yields go down.

[20] Jabir Sandhu, Sofia Tchamova, and Rishi Vala, An update on the Canadian money market mutual fund sector, Bank of Canada, October 2025, https://www.bankofcanada.ca/2025/10/staff-analytical-note-2025-25/.

[21] Thanh-Hai Ta, Jiayi Cheng, Kevin Yang and Paul Redman, An Empirical Analysis of Canadian ETF Liquidity and the Effectiveness of the Arbitrage Mechanism, Ontario Securities Commissions, June 2025, https://www.osc.ca/en/news-events/reports-and-publications/osc-etf-study.

[22] ‘Private asset funds’ may be subject to a different securities regulatory regime depending on whether such funds are deemed to be “investment funds” under applicable Canadian securities law. In contrast, ‘fund-like entities’ are considered non-investment fund issuers, making them subject to a different regulatory regime.

[23] Chris Mack, John Bulmer, Fred Gerra and Shaun Olson, Investment Fund Survey, Ontario Securities Commission, https://public.tableau.com/app/profile/osc.ifs/viz/OSCInvestmentFundSurvey/Summary.

[24] ‘Private asset fund-like entities’ also invest in private equity, private debt (such as mortgages), and real estate and offer redemptions to investors. Structured financial data is not available on these ‘fund-like entities’ because they are typically issued by exempt market dealers that are not subject to the OSC Investment Fund Survey that is completed by investment fund managers.

[25] CSA, Consultation Paper on Liquidity Risk Management Tools, Liquidity Classification, and Regulatory Disclosure and Data, November 2025, https://www.osc.ca/sites/default/files/2025-11/csa_20251127_81-102_liquidity-tools.pdf.