- The Canadian Securities Administrators’ (CSA) Systemic Risk Committee launched its first annual Systemic Risk Survey this fall to solicit views on financial risks from market participants.

- Survey responses provide the CSA with critical information for promoting financial stability and mitigating systemic risk.

- The survey was completed by 626 investment dealers and portfolio managers domiciled in Canada between October 17 and November 17.

- The survey’s response rate exceeded 60% and the aggregated results are reported on an as-is basis.

Results

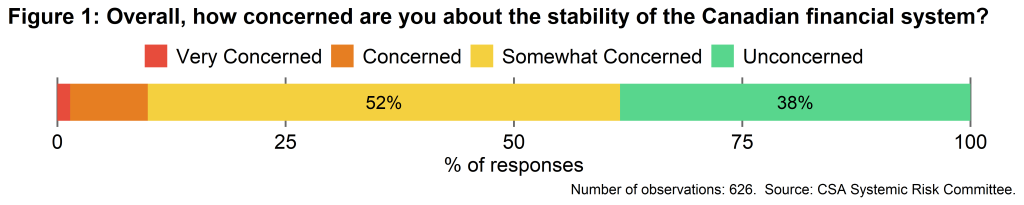

- More than 60% of respondents reported they were Somewhat to Very Concerned about the stability of the Canadian financial system (Figure 1).

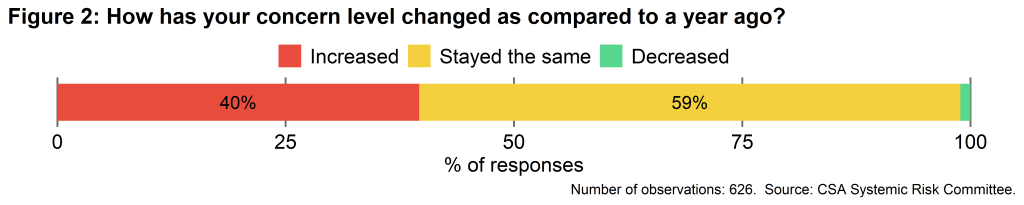

- Almost all respondents indicated their level of concern had increased (40%) or was unchanged (59%) compared to last year. Less than 1% of respondents indicated they were less concerned (Figure 2).

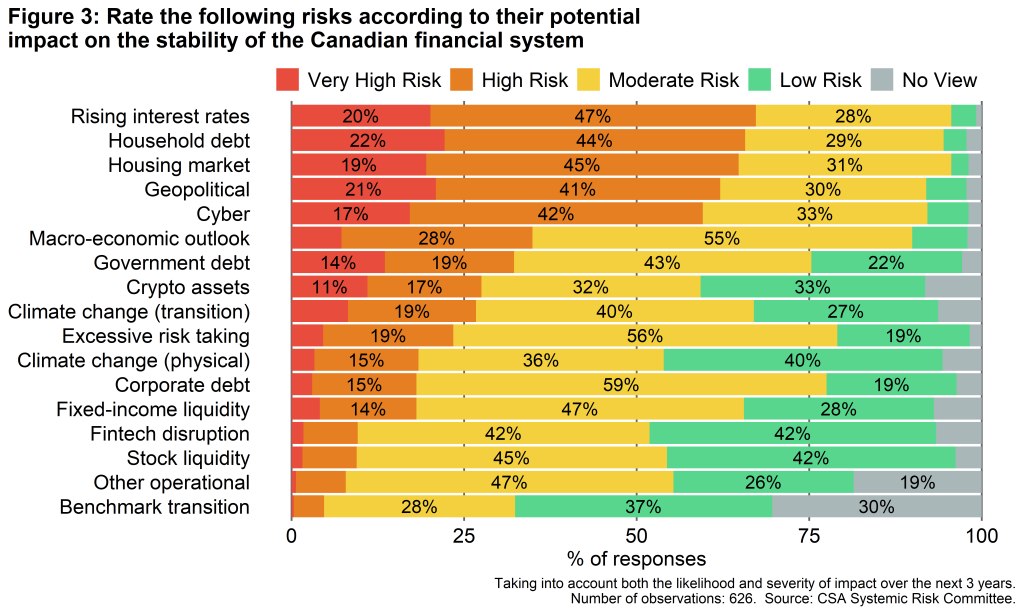

- Respondents were most concerned about rising interest rates, household debt, the housing market, the geopolitical environment and cyber vulnerabilities (Figure 3).

- The impact of rising interest rates was top of mind for respondents. More than 75% of respondents cited household, government, and corporate debt levels as at least a Moderate Risk.

- Excessive risk taking was also highlighted by more than 75% of respondents as at least a Moderate Risk.

If you have any questions, please contact:

John Bulmer

Senior Economist, Regulatory Strategy & Research, Ontario Securities Commission

Phone: 416-263-7660

Email: jbulmer@osc.gov.on.ca

Philippe Bergevin

Économiste principal, Stratégie, risques et performance, Autorité des marchés financiers

Phone: 514-395-0337 ext 4285

Email: philippe.bergevin@lautorite.qc.ca