Overview

- The Canadian Securities Administrators’ (CSA) Systemic Risk Committee completed its second annual Systemic Risk Survey this fall to solicit views on financial risks from market participants.

- Survey responses provide the CSA with critical information on market participants’ concerns about the stability of the Canadian financial system. This information helps the CSA promote financial stability and mitigate systemic risk.

- The survey was completed by 489 investment dealers and portfolio managers domiciled in Canada between October 16 and November 7.

- The survey’s response rate exceeded 48%. Aggregated results are reported below on an as-is basis.

Results

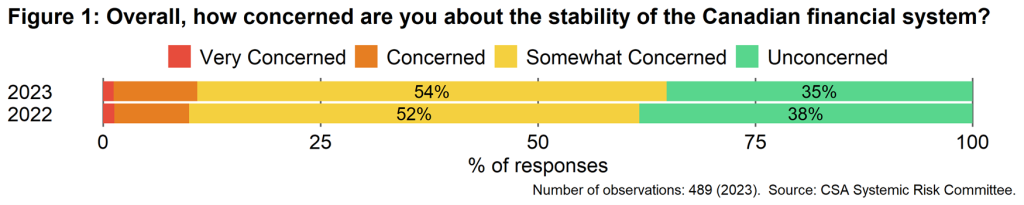

- Approximately 65% of respondents reported they were Somewhat to Very Concerned about the stability of the Canadian financial system, an increase of about 3 percentage-points from a year ago (Figure 1).

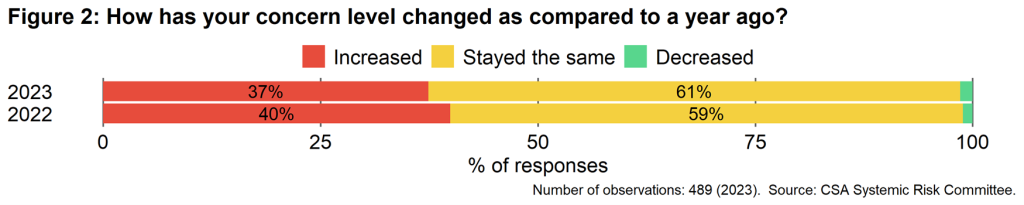

- Almost all respondents indicated their level of concern had increased (37%) or was unchanged (61%) compared to last year. Roughly 1% of respondents indicated they were less concerned than last year (Figure 2).

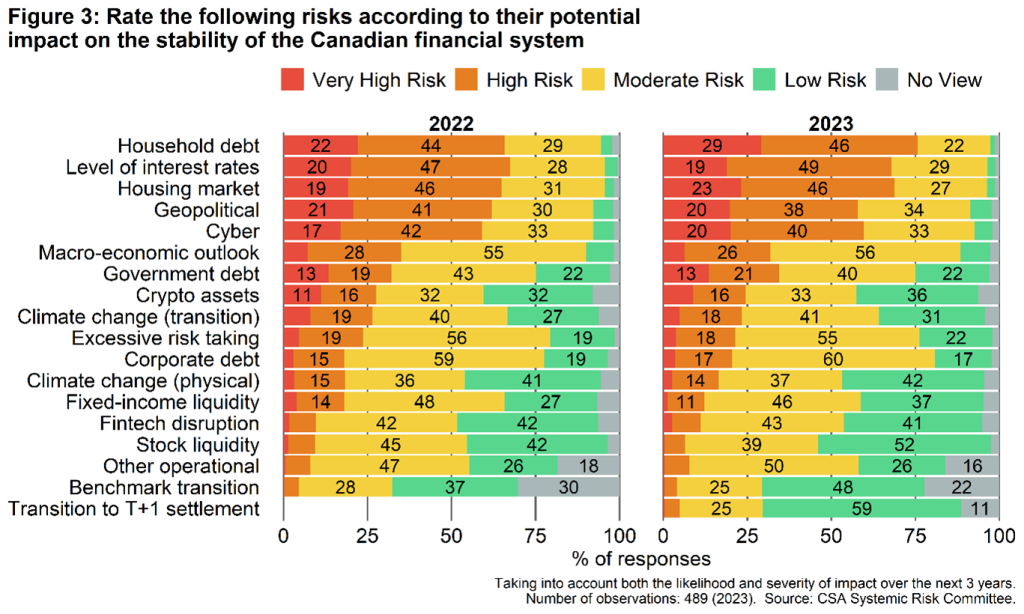

- Respondents were most concerned about household debt, high interest rates, the housing market, the geopolitical environment, and cyber vulnerabilities (Figure 3).

- More than 75% of respondents indicated that, in their view, household debt posed a High Risk or Very High Risk to Canadian financial stability.

- Respondents were relatively sanguine about the risks associated with the transition of interest rate benchmarks from CDOR to CORRA in credit and derivatives markets and the transition from two trading days to one (T+1) for the standard settlement period.

If you have any questions, please contact:

John Bulmer

Regulatory Strategy and Research, Ontario Securities Commission

Email: jbulmer@osc.gov.on.ca

Philippe Bergevin

Bureau de l’économiste en chef, Autorité des marchés financiers

Email: philippe.bergevin@lautorite.qc.ca